Works on the Following Platforms

TradingView

For use on the TradingView platform

As the world of trading becomes increasingly complex and competitive, it is crucial to understand the concept of institutional strength and flow. Institutional strength and flow can be defined as the movement of large institutional orders in the market, which can have a significant impact on the price of an asset.

What are Institutions?

Institutional investors, such as pension funds, hedge funds, and mutual funds, these investors handle substantial amounts of capital and their trades can have a considerable impact on the market. As a result, it is essential to understand and interpret the impact of these trades on the price of an asset.

What is Institutional Strength?

Institutional strength is a measure of the influence of institutional investors on the market. It represents the percentage of total trading volume that is attributed to institutional investors. To calculate institutional strength, we need to divide the total trading volume conducted by institutional investors by the total trading volume for the market. The resulting percentage provides an indication of the degree to which institutional investors are driving market activity.

What is Institutional Flow?

Institutional flow measures the net buying and selling activity of institutional investors in a particular stock or market. It provides insight into the sentiment of these investors and the direction of the market. To calculate institutional flow, we need to subtract the total selling volume of institutional investors from the total buying volume. The resulting number can be positive or negative, indicating whether institutional investors are buying or selling a particular security or market.

What is the difference between institutional strength and flow? Institutional strength measures the influence of institutional investors on the market, while institutional flow measures the net buying and selling activity of these investors.

How to use the Institutional Strength & Flow Indicator

The indicator can be a useful tool for traders in several ways, including identifying market trends, determining market sentiment, spotting divergences, and identifying overbought or oversold conditions.

Institutional strength and flow can provide valuable information for traders and investors. High institutional strength may indicate that institutional investors have a strong interest in a particular market or security. This could be a sign of bullish sentiment and may indicate that prices are likely to rise. Conversely, low institutional strength may suggest that institutional investors are less interested in a particular market or security. This could be a sign of bearish sentiment and may indicate that prices are likely to fall.

Institutional flow can also provide insight into market sentiment. Positive institutional flow indicates that institutional investors are buying a particular market or security. This could be a sign of bullish sentiment and may indicate that prices are likely to rise. Negative institutional flow indicates that institutional investors are selling a particular market or security. This could be a sign of bearish sentiment and may indicate that prices are likely to fall.

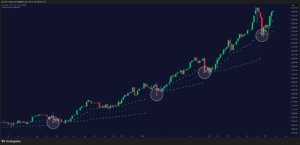

To identify market trends, traders can track institutional activity and get a sense of which way the market is headed. By analyzing positive or negative institutional flow, traders can gauge bullish or bearish sentiment and make predictions about whether prices are likely to rise or fall.

Traders can also use the indicator to spot divergences between the indicator and the price of a particular stock or market. For example, if the price of a stock is trending upwards while the indicator is trending downwards, this may suggest that the market is weakening and it could be a good time to sell. Conversely, if the price of a stock is trending downwards while the indicator is trending upwards, this may indicate that the market is strengthening and it could be a good time to buy.

Finally, traders can use the indicator to identify overbought or oversold conditions. If the indicator is above its scaling factor of 1, this could suggest that the market is overbought and due for a correction. Conversely, if the indicator is below 0, this may indicate that the market is oversold and due for a rebound.

Institutional Strength & Flow Features

The main features are:

- Institutional Strength

- Institutional Flow

Additional features:

- Volatility Bands

![Money Flow [High/Low]](https://www.zeiierman.com/wp-content/uploads/2025/09/66bcf11b7e7a5735d819e5f1_Money20Flow205BHigh3ALow5D-300x143.jpg)