Works on the Following Platforms

TradingView

For use on the TradingView platform

The volatility Impulse Indicator measures the speed of price movements. This indicator will help to identify whether the market is showing signs of rapid price changes or a more stable market. The indicator is also used to measure short-term market momentum. It helps traders identify when the market is changing direction and prepare for potential trading opportunities.

Volatility Impulse can help investors to understand the market sentiment better and act accordingly. Investors can use this tool to analyze the market’s reaction to news events and other rapid price changes. By understanding the impact of volatility on the market, investors can make more informed decisions and navigate the markets more confidently.

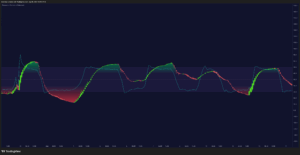

Traders can use Volatility Impulse to identify potential entry and exit points in the market. For example, if the Volatility Impulse indicates that the market is exhibiting higher-than-normal volatility (the indicator peaks above or below the bands), traders may look to enter the market with a long or short position depending on the current market, or it can be a great sign to take profit. If the indicator peaks above the upper band, it can indicate a positive breakout or possible bearish reversal. If the indicator peaks below the lower band, it can indicate a negative breakout or possible bullish reversal. Traders that combine this indicator with knowledge about trend and consolidation areas will find it extremely powerful.

Additionally, traders can use Volatility Impulse to identify potential areas of support and resistance in the market. If the Volatility Impulse indicates that the market is exhibiting higher-than-normal volatility, then traders may look to enter the market near the area of support.

Key Knowledge

Traders should also consider the overall trend of the markets when using the Volatility Impulse to identify potential entry and exit points. By combining the Volatility Impulse with an understanding of the overall trends, traders can more effectively identify profitable entry and exit points.

HOW TO USE (Simple Setup)

To use volatility impulse in trading, start by choosing a time frame that suits your trading style. A shorter time frame is typically better for day traders, while longer time frames are more suitable for swing traders.

Once you have chosen your time frame, look for points where the volatility impulse line crosses above or below the zero line. This indicates a change in market direction. If the volatility impulse line crosses above the zero line, it could be a sign of an upward trend, and a signal to buy. Similarly, if the volatility impulse line crosses below the zero line, it could signal a downward trend, and a signal to sell. These signals should be used in conjunction with other technical indicators to confirm the direction of the market and make more informed trading decisions.

When trading volatility impulse, one important thing to remember is always to be aware of the risks. While the strategy can be profitable, it is also risky, and there is no guarantee of success. Always use a risk management strategy such as a stop loss and take profit order to limit losses and protect profits.

HOW TO USE (Volatility Peak Setup)

Use the indicator to find areas where the market signals high volatility and use those opportunities to find either breakouts traders or reversal traders, depending on how the overall trend looks like. If the trend is exhausted, you may use the volatility peak (when the indicator peaks above/below the bands) as a sign that a possible reversal is likely.

Combine the indicator with the Volatility Index for more confluence.