Works on the Following Platforms

TradingView

For use on the TradingView platform

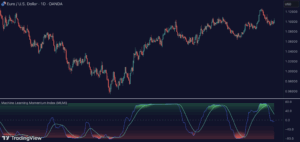

As the world of technology continues to evolve, so does the need for efficient and effective technical analysis. Our Machine Learning and Optimization Moving Average help traders find the best possible moving average and moving average crossing strategy.

An indicator that finds the best moving average

The constant changes in the market’s characteristics, such as volatility, volume, and momentum, require traders to fine-tune their indicators and strategies to fit the ever-changing market. The moving average (MA) is a popular technical indicator used to determine the trend of an asset’s price by smoothing out the price action over a specified period. However, there is no “best” MA period that suits all market conditions. To address this issue, we have developed an algorithm that self-adapts and finds the best MA period based on machine learning and optimization calculations.

This indicator helps traders and investors to use the best possible moving average period on the selected timeframe and asset and ensures that the period is updated even though the market characteristics change over time.

Self-optimizing moving average

Our algorithm optimizes the MA period within the given parameter range and optimizes its value based on either performance, win rate, or the combined results. The MA period updates automatically on the chart for traders, ensuring that the period is always up-to-date with the latest market characteristics.

- Traders can choose to use our Machine Learning Algorithm to optimize the MA values or can optimize only using the optimization algorithm.

Performance

If traders select to optimize based on performance, the calculation returns the period with the highest gains. This approach is useful for traders who prioritize maximizing their profits.

Winrate

If traders select to optimize based on win rate, the calculation returns the period that gives the best win rate. This approach is useful for traders who prioritize their win rate over their profitability.

Combined

If traders select to optimize based on combined results, the calculations score the performance and win rate separately and choose the best period with the highest ranking in both aspects. This approach is useful for traders who aim to balance their profitability and win rate.

How To Use

Finding the best-moving average for any asset and timeframe

Traders can choose to find the best-moving average based on price crossings.

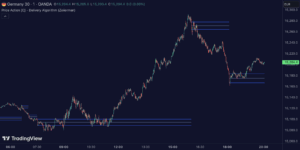

Finding the best combination of moving averages for any asset and timeframe

Traders can choose to find the best crossing strategy, where the algorithm compares the 2 averages and returns the best fast and slow periods.

Alerts

Traders can choose to be alerted when a new best-moving average is found or when a moving average cross occurs.