Real-life experience trading large orders

Once you start to trade with big order sizes you have to start to use a function called Hidden Order blocks. These features are often used by institutions to make it possible to execute large orders. If the orders were visible other actors would easily spot the liquidity and the strategy would run the risk to get exposed. If you are a retailer trader the function will only be unlocked at your broker if you trade with positions larger than X amount.

How do I (Zeiierman) use Hidden Order Blocks to increase the likelihood of getting the price I want?

How does the Order Book look like

The order book contains the available Buy (Bid) and Sell (Ask) orders at price levels. We basically see at what price buyers are willing to buy and to what price sellers are willing to sell. The gap between the Bid and Ask is called spread. These orders are seen by all market players!

Let’s get into the fun stuff – Sell Orders

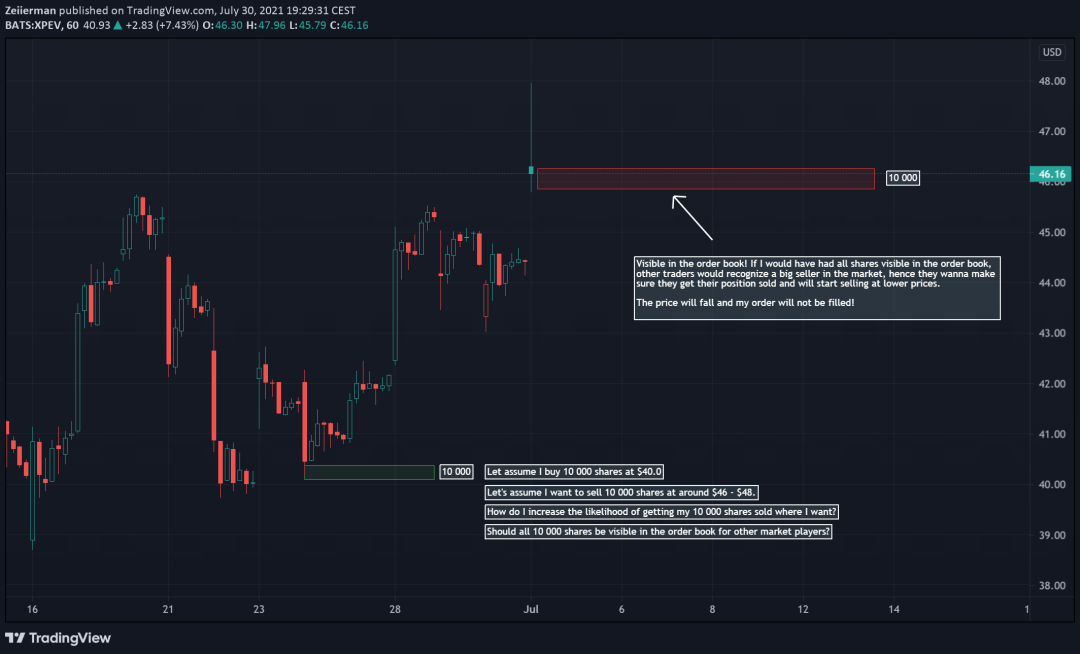

Let assume that 10 000 shares are a relatively large order in this case.

Let’s say that I bought 10 000 shares at $40.00 and had a 10-14 % target. (Around $46-48). How do I increase my likelihood of getting these 10 000 shares sold at my target?

If I would have used regular visible orders the order book would have looked quite “heavy” around $46 and other market players would have seen that there is a big seller in the market. A big seller in the market is not a good sign and other players may want to get their positions sold as well.

These other sellers may be willing to sell at a cheaper price (let say $45) just to be certain that they get their positions sold. Hence a domino effect is started where sellers “take” the Bid side at lower prices just to secure their profit. The price falls!

My large order will not be sold at all!

What should I do?

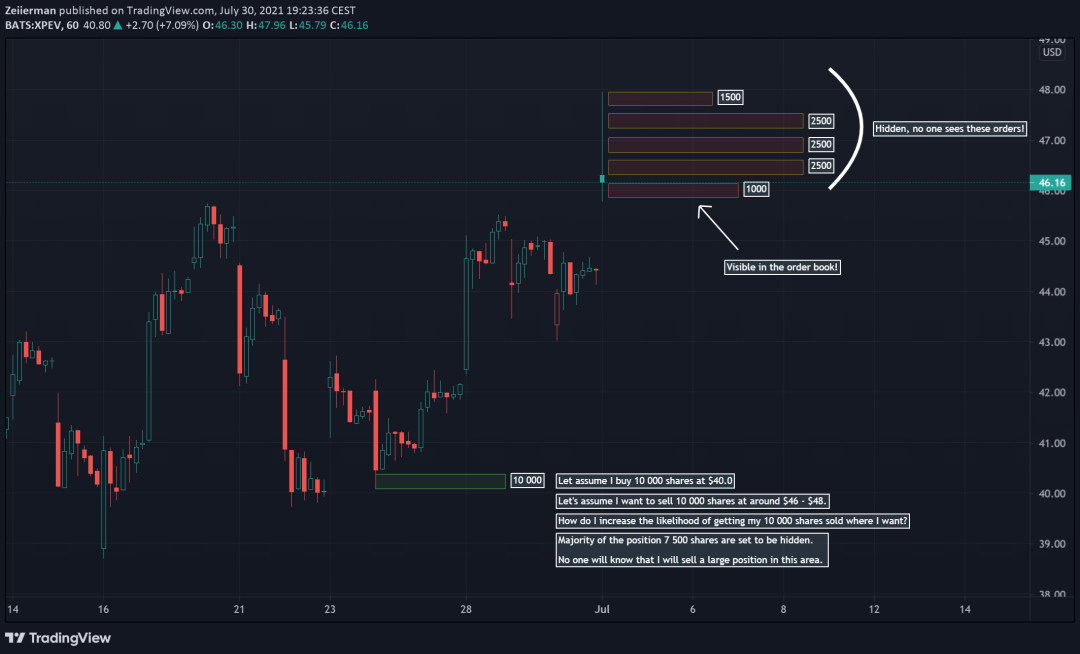

Hidden Orders

Now, since I’m trading with large positions my broker will let me place hidden orders at any price level, and no other market player will be able to see it. This function is a must-have for large players otherwise there is no chance of getting in or out of positions.

It basically lets me choose how many shares I want to be displayed at different market levels. In this example, I do not want to “look like” a big seller at a price of $46 so I only put 1000 shares visible in the book and put the rest 9000 shares as hidden. The order book will now look “light” and other market players will not recognize me as a big seller. Hence I have increased my likelihood of getting my large position sold between $46 – $48.

Buy Orders

Let’s say that that I want to buy 10 000 shares at $40.00. How do I increase my likelihood of getting these 10 000 shares filled at the price of $40?

If I would have used regular visible orders the order book would have looked quite “heavy” around $40 and other market players would have seen that there is a big buyer in the market. A big buyer in the market is a good sign and other players may want to get into buy positions as well. This big buy order indicating that there is buying pressure and no one wants to miss the move.

These other buyers may be willing to buy at a higher price (let say $42) just to be certain that they get into the trade. Hence a domino effect is started where buyers “take” the Ask side at higher prices just to secure make sure they got in. The price rise!

My large order will not get filled!

What should I do?

Hidden Orders

Now, since I’m trading with large positions my broker will let me place hidden orders at any price level, and no other market player will be able to see it. This function is a must-have for large players otherwise there is no chance of getting in or out of positions.

It basically lets me choose how many shares I want to be displayed at different market levels. In this example, I do not want to “look like” a big buyer at a price of $40 so I only put 1000 shares visible in the book and put the rest 9000 shares as hidden. The order book will now look “light” and other market players will not recognize me as a big buyer. Hence I have increased my likelihood of getting my large position filled around $40.

Do you like these kinds of insights and should I write more about this? Let me know!