Trading has always been a game of sense, instinct, and a whole lot of screen time. But the playing field is changing. Today, the conversation isn’t just about whether you’re a fundamental or a technical trader. It’s about how you’re utilizing newer technology to elevate your capabilities.

Lately, it has been our experience that the traders who understand the right rhythm between AI analysis and human judgement do a LOT more than just surviving in the market. Instead, they actually build a real edge for generating profits.

This is the dream team I prefer utilizing: AI handles the heavy lifting, scanning, and identifying patterns, allowing you to make a more informed judgment and execute the trade for profit.

1. How to trade with AI like a pro?

For this article, I’ll mostly be using the example of the Zeiierman AI Chart Analyzer, primarily because I made it after a lot of backtesting and prefer it over most tools in the market.

When paired with an understanding of Smart Money flow and powerful indicators on TradingView, the tool provides a second layer of confirmation that is faster, more consistent, and less biased than our own analysis.

Here’s a step-by-step example:

Step 1: Your Observation (Initial Bias)

You notice EUR/USD is dropping into a previous demand zone. On first glance, you think this may be an SMC-style liquidity sweep of the lows before a reversal. But you have doubts about a clean Break of Structure (BOS), or just a retracement? Is there a Fair Value Gap (FVG) worth targeting?

Rather than guessing, you can upload the chart to Zeiierman’s AI Chart Analyzer.

Read: Fair Value Gaps (FVGs): The Hidden Zones Institutions Leave BehindStep 2: AI analysis

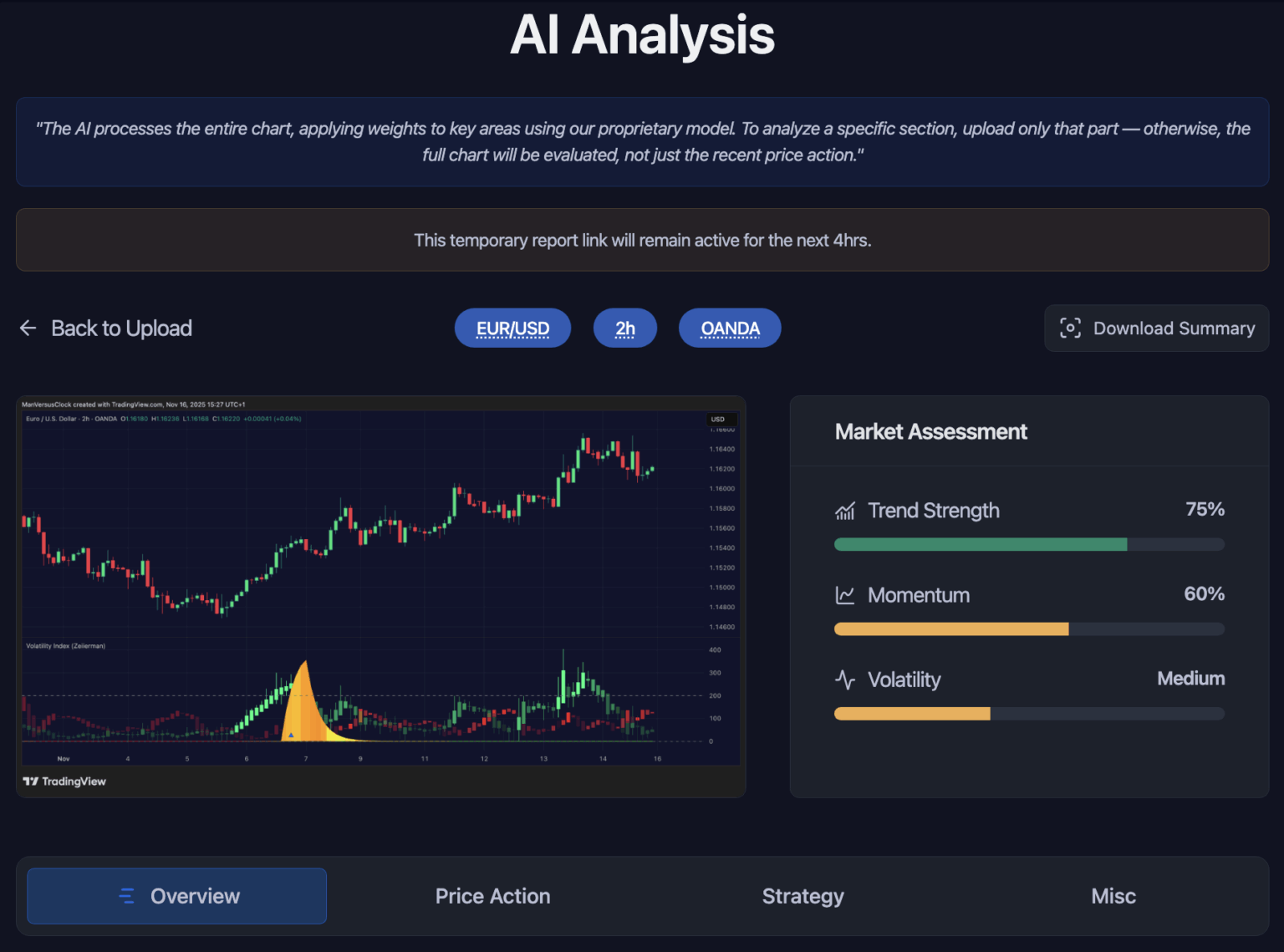

You upload a clear chart, and within seconds, you get a complete objective analysis in real time. The result gives structured points that can include a confirmed break of structure with accurately marked FVG or OB with a high probability of retracement.

With this analysis, you get a general idea of price action and risk measure, with a suggested strategy.

Step 3: Cross-Checking with Zeiierman Indicator

Now you can overlay their Zeiierman Order Block Finder and Liquidity Zone indicators for that extra precision.

Order Block Finder: Use this to verify whether the flagged order block is accurate.

Liquidity zones: This indicator helps you identify significant liquidity zones where the price may experience support or resistance.

FVG: You can use this to confirm the position of the FVGs; it also highlights potential entry points and directional bias using smart volume logic and adaptive visual elements.

Step 4: Trade Execution (Human Judgment)

Finally, it is up to you to make a healthy trade decision. AI Analyzer gives you the backing with its objective and data-driven analysis, but it’s your job to understand and look out for context outside the chart. You can refine the suggested entry, exit, and risk measure according to your trading style.

As a modern trader, your edge doesn’t come from choosing between your own analysis or AI, but it actually comes from mastering both. AI gives you the raw speed and unbiased analysis of a market, while your experience provides the crucial context, creativity, intuition and adaptability that the market demands. Zeiierman’s AI Chart Analyzer bridges that gap, giving you actionable clarity without stripping away the role of your judgment.

The question isn’t if AI will change trading, cause it already has. The only question now is whether you’ll be on the winning side of that change.

Where AI gives an edge in trades

Humans are great at spotting simple chart patterns, but we’re no match for AI analyzers when it comes to finding complex, hidden relationships in the chart.

It’s not like AI is more intelligent than you, but it’s faster and brutally consistent. This combination can help you turn messy markets into actionable ideas you can actually execute. To list a few advantages AI will give you while trading:

1. Speed & Scale You Can’t Match Manually

While you are scanning a particular chart, an AI can scan it on multiple time frames in in half the time. Like in the Zeierrman AI analyzer, you just have to upload a real-time chart image, and it will give you an actionable result that helps you gain market clarity faster. It can help you scan across multiple timeframes and conditions in seconds. It gives entry and exit conditions, suggesting where to place your profit targets and stop-losses to maintain a good risk-to-reward ratio. This is a massive help, especially for newer traders who struggle with building a solid trade plan.

Read: How to Maximize Profits with Zeiierman’s AI Chart Analyzer2. Built-In Objectivity (No Fear, No FOMO)

AI analysis provides a clear, objective review of the market’s pulse. It can provide scores for trend strength, momentum, and volatility on a scale of 1 to 100. This is a massive benefit because it cuts through the noise and gives you a data-backed reality check. No more “I think this is a strong trend’’ because now you have a number to work with.

The emotional neutrality with AI in your setup also means:

- Consistent risk management – No revenge trading or position sizing based on emotions.

- Objective – It helps build discipline and doesn’t see patterns that aren’t there during losing streaks.

- Approach – follow a systematic process, whether the market is up, down, or sideways.

3. Pattern Recognition at the next level

One of the greatest advantages AI brings to trading is its ability to recognise patterns that most human eyes would never notice, no matter how many hours are spent staring at charts. This kind of advanced recognition becomes especially valuable in high-frequency or intraday trading, where opportunities appear and disappear in mere seconds. Our brain may be sharp, but it is wired to notice the obvious, not the microscopic. Even if a trader is experienced, there’s no competing with an engine that can digest huge data and constantly refine its understanding of what “patterns” actually lead to profitable outcomes.

That doesn’t mean AI is perfect. Algorithms can sometimes surface patterns that are mathematically sound but practically useless if they don’t fit into a larger market context. But when used as a complement to human judgment, this advanced recognition becomes a lethal weapon in the game.

Where Human Judgment still plays a critical role

I know what everyone is thinking these days. If AI is so great at technical analysis, why don’t we just let it take over entirely? It is tempting, right?

But the market isn’t just a set of jumping numbers, it is a living, breathing beast driven by human psychology and global events. And this is where the AI usually falls short.

The power of experience can never be replaced in the market. An experienced trader has seen it all, like crashes, bubbles, black swans, and periods of insane volatility. They’ve lived through these events and have developed a gut feeling (intuition) about how a market might behave in various situations and contexts.

The awareness of narrative is important in the market, and that is where we find gaps in our analysis and AI analysis. AI can point out correlations in complex structures on charts, but it doesn’t always understand the “story” behind the market.

Consider an unexpected central bank announcement or a sudden geopolitical event. To an algorithm, these are just new data points entering the stream, but to an experienced trader, these events are signals loaded with signs about sentiment, positioning, and the likely behaviour of other market players.

So, while AI offers speed, scale, and objectivity, it is not always the complete picture. Markets are as much about psychology, context, and adaptability as they are about numbers, and the real traders recognise this.

They don’t use AI as a substitute, but as a reliable partner. AI can scan the huge area of the market and highlight opportunities, but it takes human judgment to decide which opportunities are a match with the bigger picture, risk appetite, and the behaviour of other players in markets.