Ever watched a “sure thing” trade reverse the instant you hit buy? That gut punch isn’t bad luck—it’s often institutional order blocks (OBs) steamrolling retail traders.

While most retail traders scratch their heads to figure out what happened, experienced traders see it coming from a long way away. They read the institutional footprints left behind in the charts – what we call order blocks.

In simple terms, Order Blocks (OBs) are areas on a price chart where large institutions, such as banks, hedge funds, or major market makers, place substantial orders that significantly impact the market.

These moves by the big player create an imbalance between supply and demand that often gets revisited by price later. If you’ve ever felt like you’re always one step behind the big players in the market, this guide will change that. I’ll walk you through everything you need to know, from beginner-friendly concepts to advanced strategies and tips that hedge funds may not want you to know.

1. What are order blocks?

Think of order blocks like footprints in fresh snow. When a massive institutional trader – we’re talking hedge funds, banks, or pension funds with millions to deploy – makes their move, they can’t just hide their tracks completely. These are the “whales” if you’re more familiar with crypto terminology.

Institutional traders often leave behind specific patterns that can show exactly where they entered the market. These order blocks play a significant role as they impact market sentiment, price action, and liquidity. They are the last bullish or bearish candles before a significant market move (a break of structure or strong impulse).

Unlike basic support and resistance or supply and demand zones, order blocks come with a plan and confirmation. Let me give you a proper differentiation.

| Traditional Support and Resistance | Order Blocks |

|---|---|

| Based on obvious highs and lows | Driven by institutional activity |

| Often fail due to crowd behaviour | More reliable due to institutional backing |

| Levels are based on prior price action and visible highs/lows. | Indicates areas of potential imbalance and liquidity |

| Support/resistance levels are validated by the price consistently bouncing off those levels. | Order Blocks are validated by a “break of structure” or “change of character” in price action. |

2. Types of Order Blocks

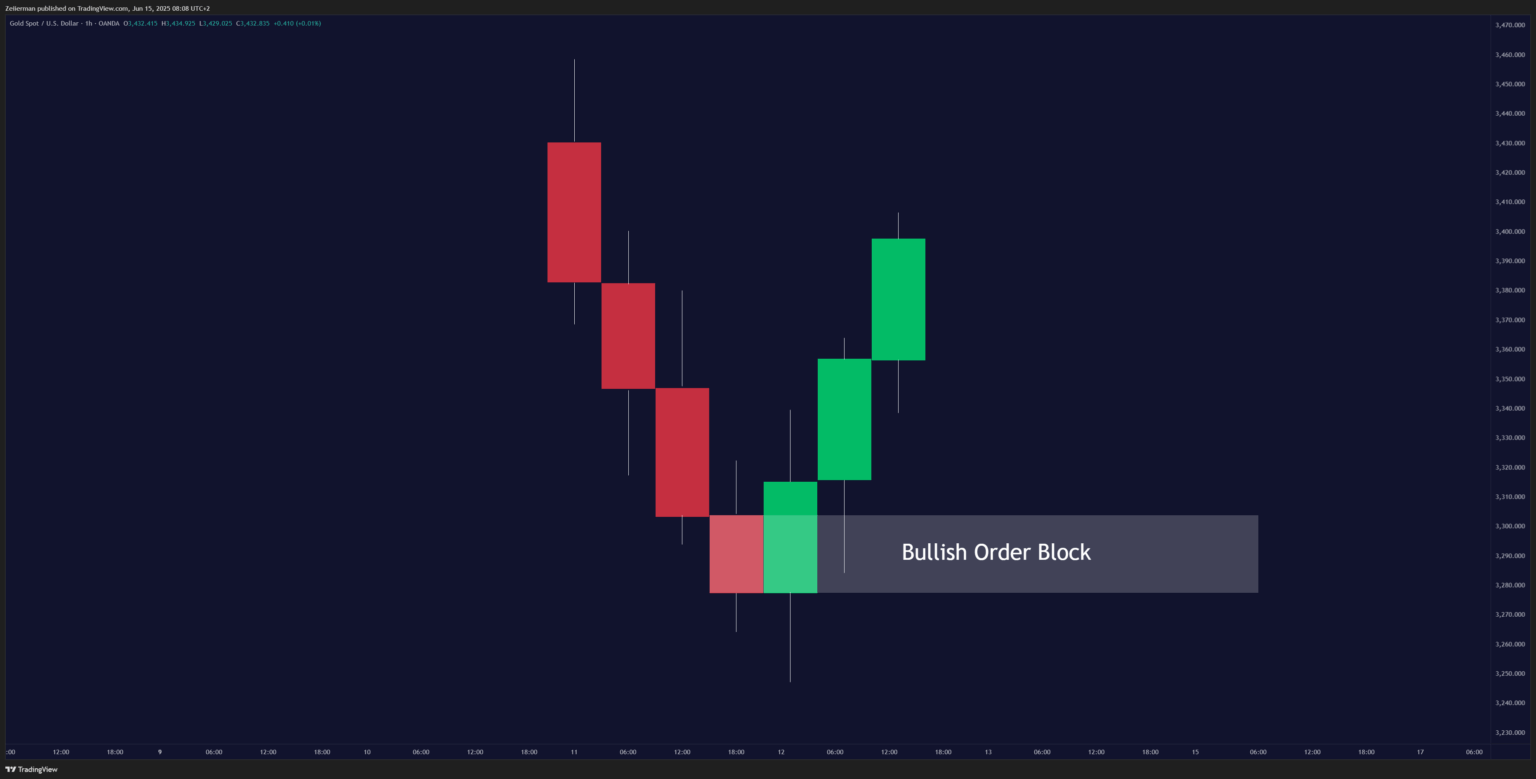

I. Bullish Order Blocks

A bullish order block forms when institutions buy but disguise it as a sell first. These blocks are often found at the end of a down move. Here’s what to look for:

- Strong bearish move – Price drops aggressively, creating retail panic

- Last bearish candle – The final down candle before the reversal

- Sharp reversal – Price immediately changes direction and moves up strongly

The magic happens in that last bearish candle. While retail traders see weakness and sell, institutions are absorbing all that selling pressure and quietly accumulating their long positions.

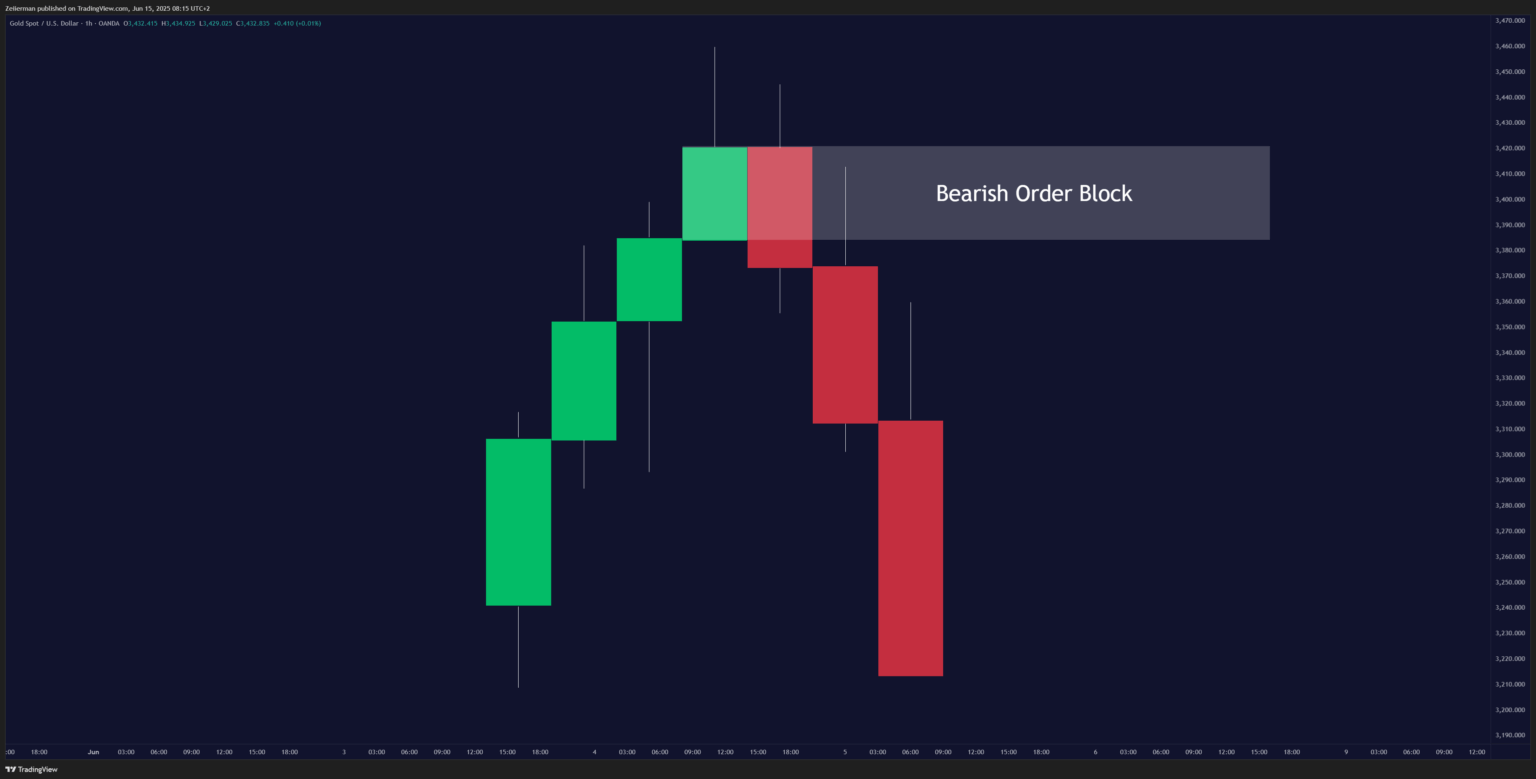

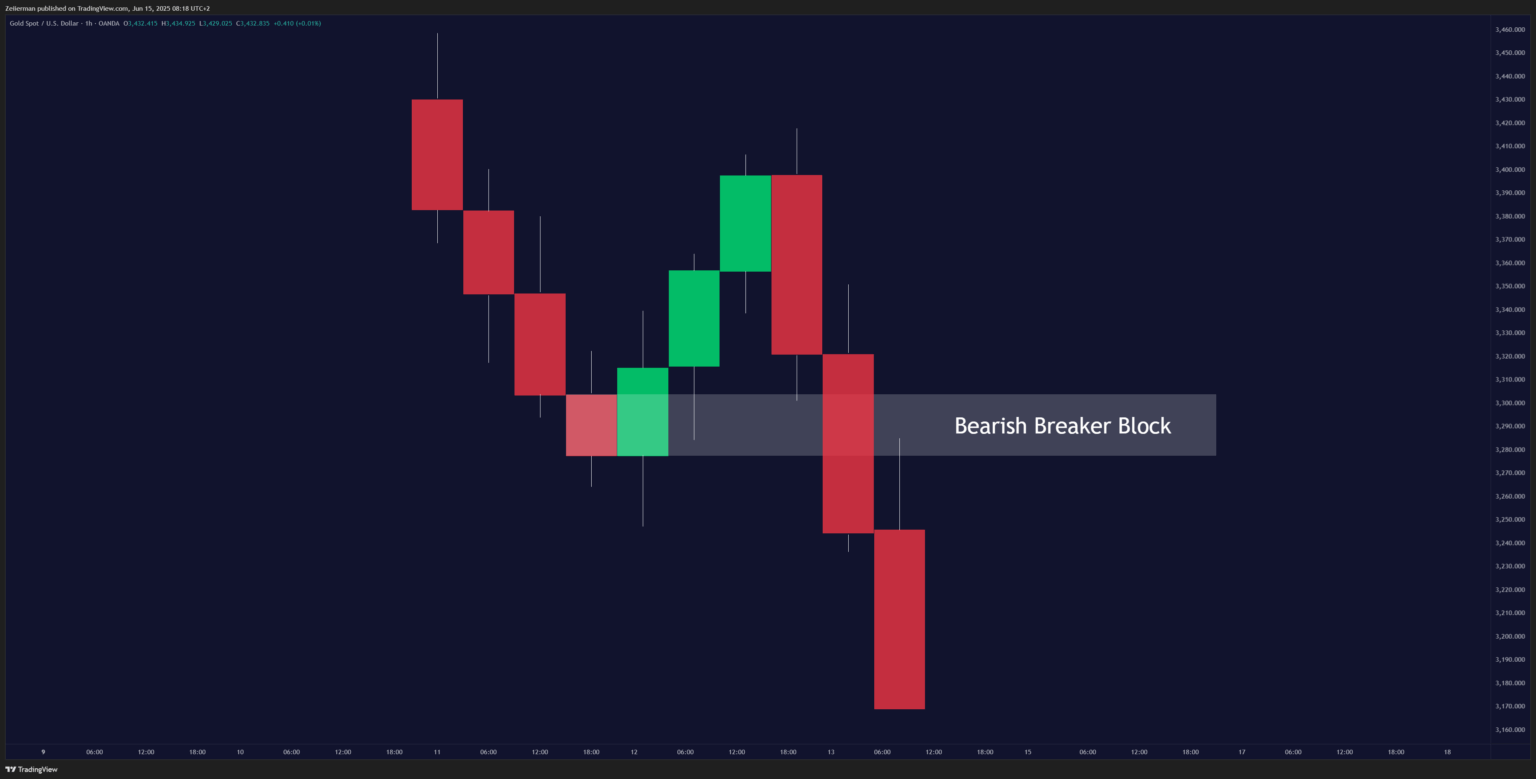

II. Bearish Order Blocks

Bearish order blocks work in reverse. Institutions create the appearance of buying pressure while actually distributing their long positions or building short positions. The pattern looks like this:

- Strong bullish move – Price rallies hard, creating FOMO. This traps the retailers.

- Last bullish candle – The final up candle before distribution begins

- Sharp reversal – The price immediately drops as institutions reveal their hand.

The last bullish candle before a major reversal typically marks the point at which institutions liquidate their positions. When the price returns to test that level, it’s often rejected hard because there is still selling pressure waiting there.

Read: How to Trade Wedges Like a Pro: Rising & Falling Wedge Strategies ExplainedIII. Breaker Blocks

Institutions’ favorite trap: fake a breakout, then reverse. The game gets really interesting here.

A breaker block occurs when an order block becomes completely broken and invalidated but then transforms into the opposite type of order block. How breaker blocks form:

- Start with a valid order block (let’s say bullish)

- Price returns and breaks through the zone completely, not just a wick

- The broken zone now becomes a bearish order block – institutions that were buying are now selling.

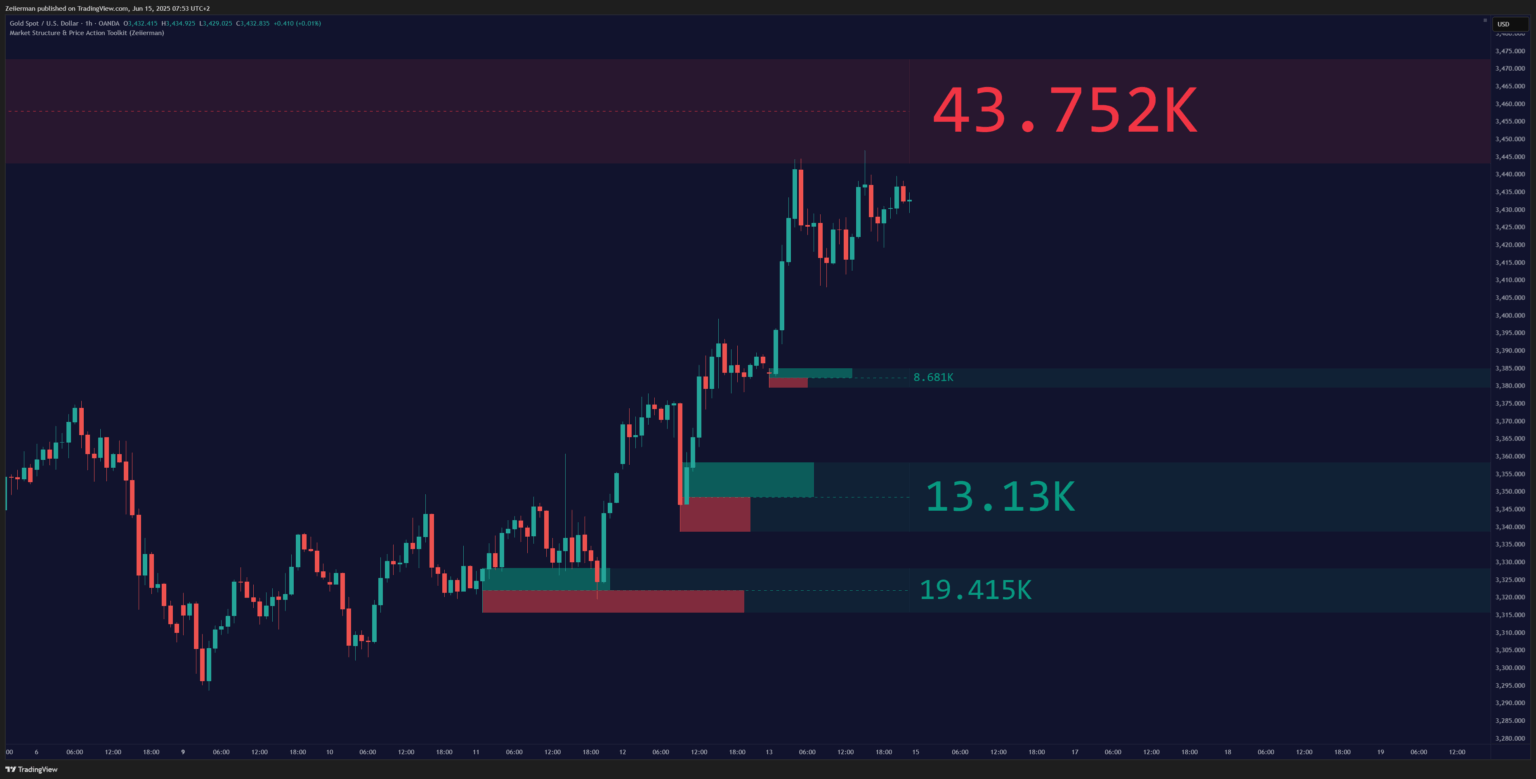

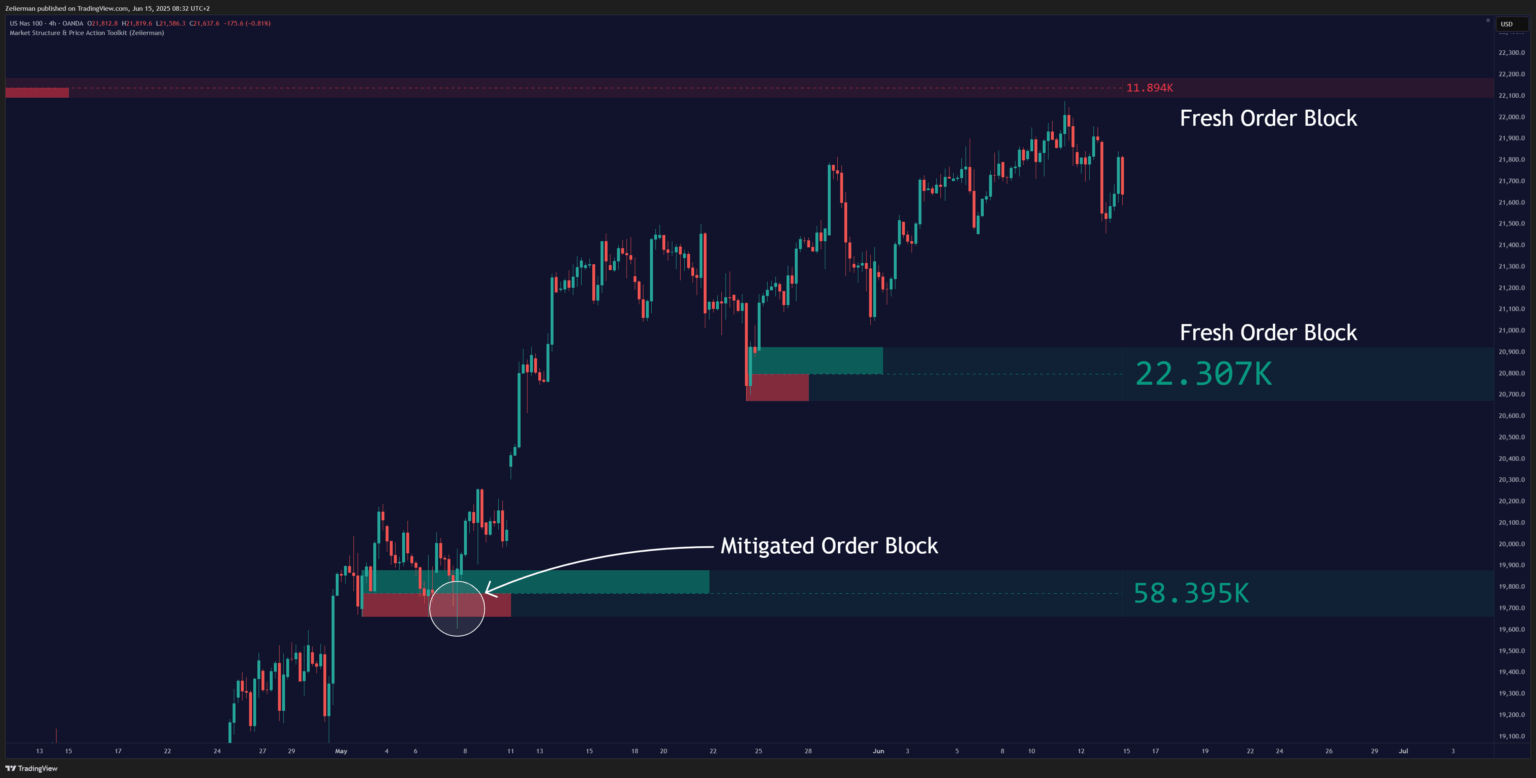

IV. Fresh vs. Mitigated Order Blocks

Trust me, this distinction is crucial for your win rate.

Fresh Order Blocks: Blocks that haven’t been tested yet, as prices return to the zone. These are like loaded springs with maximum potential energy because the institutional orders haven’t been fully executed yet.

Mitigated Order Blocks: Price has already returned and tested the zone at least once. Some of the institutional pressure has been relieved, making them less reliable for future trades.

📌 Look out for fresh order blocks over those that have been mitigated. The first test of an institutional zone typically has the highest probability of working.

3. How to Identify Order Blocks?

To find order blocks, you have to understand how and why order blocks work. Let’s all try and think like an institution for a minute. Say you’re managing a $2 billion fund, and you want to buy Apple stock. You can’t just buy $100 million worth of shares because you’d push the price up against yourself. Here’s what you most likely do:

- Wait for weakness – Find a moment when retail traders are selling

- Accumulate quietly – Build your position without revealing your hand

- Create the appearance of selling – Maybe even short a little to push the price down

- Execute your real buying – When everyone thinks the stock is weak

Now for the practical stuff. Here’s my 3-step process for identifying high-probability order blocks:

Step 1: Spot the Impulse Move

You’re looking for moves that stand out from normal price action. Spot aggressive moves that happen quickly and cover significant distances.

Traits of the move:

- It must be strong and immediate after consolidation.

- Creates an obvious change in character

- Bullish OB: Sharp rally. Bearish OB: Nosedive.

- Volume should spike here. No volume? Suspect.

Step 2: Locate the Last Opposing Candle

This is where most beginners typically make mistakes. You want the last candle that moved against the impulse move, not just any candle.

For a bearish order block, find the last bullish candle before the significant drop.

For a bullish order block, identify the last bearish candle preceding the significant rally.

Step 3: Mark Your Zone Precisely

Don’t just draw a line – create a zone. Your order block extends from the top (high of the opposing candle) and bottom (low of the opposing candle).

This gives you a range to work with rather than trying to pick exact prices, which is how institutions think about the market. Price MUST return to the OB zone later, and that is your trigger.

Institutional logic: “Is leftover buy/sell interest still here?”

Read: Mastering the 2B Reversal Pattern: Strategies for Forex and Crypto Markets4. Order Blocks Across Different Markets

Market Comparison Table:

| Market | Best Timeframes | Zone Width | Key Considerations |

|---|---|---|---|

| Forex | 4H, Daily, Weekly | 15-50 pips | Session overlaps, news events |

| Crypto | Daily, Weekly | 100-500 points | Bitcoin dependence, regulatory news, hype |

| Individual Stocks | Daily, Weekly | 1-5% of the price | Earnings reports, sector rotation |

| Stock Indices | 4H, Daily | 0.5-2% of the price | Economic data, institutional flows |

One of the most powerful aspects of order block trading is that institutional footprints appear everywhere big money operates. However, each market has its own personality when it comes to how these zones behave.

I. Order Blocks in Forex trading

Forex is like an institutional playground. You can often find order blocks glowing throughout the market since banks and institutions typically trade billions to dominate the forex market.

Forex Order Block Specifics:

- Use 15-30 pip zones for major pairs

- Weekly and monthly order blocks are extremely powerful

- Economic news can temporarily override order blocks but often confirms them long-term

Trap to Avoid: Asian session “blocks” often result in fakeouts; wait for volume spikes during London/NY hours.

II. Order Blocks in Cryptocurrency Markets

Crypto markets present unique opportunities for order block traders because of their 24/7 nature and high institutional adoption in recent years. Crypto markets respect order books (OBs) but require caution. Here’s what makes crypto markets different from forex when it comes to order blocks:

Higher Volatility: Order block zones need to be wider. A 20-pip zone in forex could be a 200-pip zone in Bitcoin.

Whale Activity: Large individual holders can create order block-like patterns, not just institutions. A good thing about crypto is that you can track whale movements through order books in a trading platform or in whale tracking sites that monitor major blockchain transactions.

Exchange-Specific Activity: Order Books (OBs) on Binance often differ from those on Coinbase due to fragmented liquidity. Use volume-profile tools to confirm block validity 3.

Liquidation Clusters: $1M+ liquidations near OB zones act as confirmation signals (e.g., Ethereum’s $3.4K OB reversal coinciding with $200M liquidations)

Meme Coin Exclusion: Avoid low-volume/value assets (e.g., DOGE)—OBs rarely hold due to pump-and-dump schemes

III. Order Blocks in Stock Trading

Individual stocks and stock indices both show clear order block patterns but with some important distinctions from forex and crypto. Unlike forex or crypto, stock OBs are heavily influenced by dark pool activity, earnings events, and single-stock liquidity dynamics.

For individual stocks, here’s what you need to look for:

Earnings Season Considerations: Order blocks formed just before an earnings release can be incredibly powerful if the company beats expectations, or they can be completely invalidated if the company misses.

Volume Confirmation: Unlike forex, you can see actual volume in stocks. Order blocks with high volume are much more reliable.

Sector Rotation Effects: A perfect Apple order block might fail if the entire tech sector is rotating out of favor.

📌 Some tips for you:

- Focus on high-volume, liquid stocks (Apple, Tesla, Microsoft)

- Check sector performance before trading individual stock order blocks

- Earnings date release can override technical levels temporarily

For stock indices (SPX, NASDAQ, etc.), here’s what you need to look for:

Institutional Rebalancing: End-of-month and end-of-quarter periods create powerful order blocks as institutions often rebalance their portfolios.

Economic Data Impact: Look out for employment reports, Fed meeting minutes, and GDP data, as they can strengthen or weaken order block setups.

Market Hours Matter: Order blocks formed during regular trading hours are more reliable than those formed during after-hours or pre-market sessions.

📌 Some tips for you:

- Observe the ETFs for a better pattern and easier execution.

- Focus on weekly and monthly order blocks for longer-term trades.

- Always consider overall market sentiment and the economic calendar.

5. Advance Trading with Order Blocks (for Pros)

Once you’ve mastered basic order block identification, it’s time to think like the institutions themselves. This means understanding the broader context of Smart Money Concepts (SMC) and how liquidity drives everything in the markets.

I. Integration with Smart Money Concepts

Order blocks are like the DNA of institutional trading – but they’re supercharged when combined with core SMC.

- Break of Structure (BOS): When price breaks a recent high or low, it often signals a potential change in institutional sentiment. Always remember that fresh order blocks that form after a BOS are considered more reliable.

- Liquidity Sweeps: Institutions slowly build positions, creating small order blocks. Then comes the manipulation phase, where price sweeps liquidity to shake out weak hands. Finally, the real move begins, often respecting order blocks from the accumulation phase.

- Fair Value Gaps (FVG): Imbalances left behind when price moves aggressively. These are price gaps that often work hand in hand with order blocks. When you see a Fair Value Gap near an order block, it increases the probability that institutions will fill both the gap and respect the order block level.

📌 When you see a liquidity grab → FVG → OB → BOS sequence, you’re looking at a high-probability institutional setup.

II. Role of liquidity and institutional activity

Price doesn’t move randomly; it moves to collect liquidity. Think about it this way: Institutions need to buy and sell massive positions. But to do that, they need someone on the other side of their trades. Where do they find this liquidity? At levels where retail traders are most likely to place their stop and entry points.

Liquidity is the lifeblood of institutions. Without it, their orders create too much slippage. So, they manufacture liquidity.

Here’s how the liquidity hunt goes:

- Identify retail positioning – Where are most traders long or short? Yes, big players can actually see your stops in the clusters.

- Sweep liquidity zones – Push price to trigger stops and breakout trades.

- Execute institutional orders – Use the liquidity to build or close positions.

- Reverse direction – Move price toward the real institutional objective.

This is why you’ll often see price “hunt” obvious support or resistance levels before making the real move. Institutions are accumulating the liquidity they need to support their broader objectives.

6. Order Block Trading Strategies

Order Blocks (OBs) are only as good as your ability to trade them with context. Knowing where they form is one thing — executing with precision is another. There are two strategies that I primarily use with OBs:

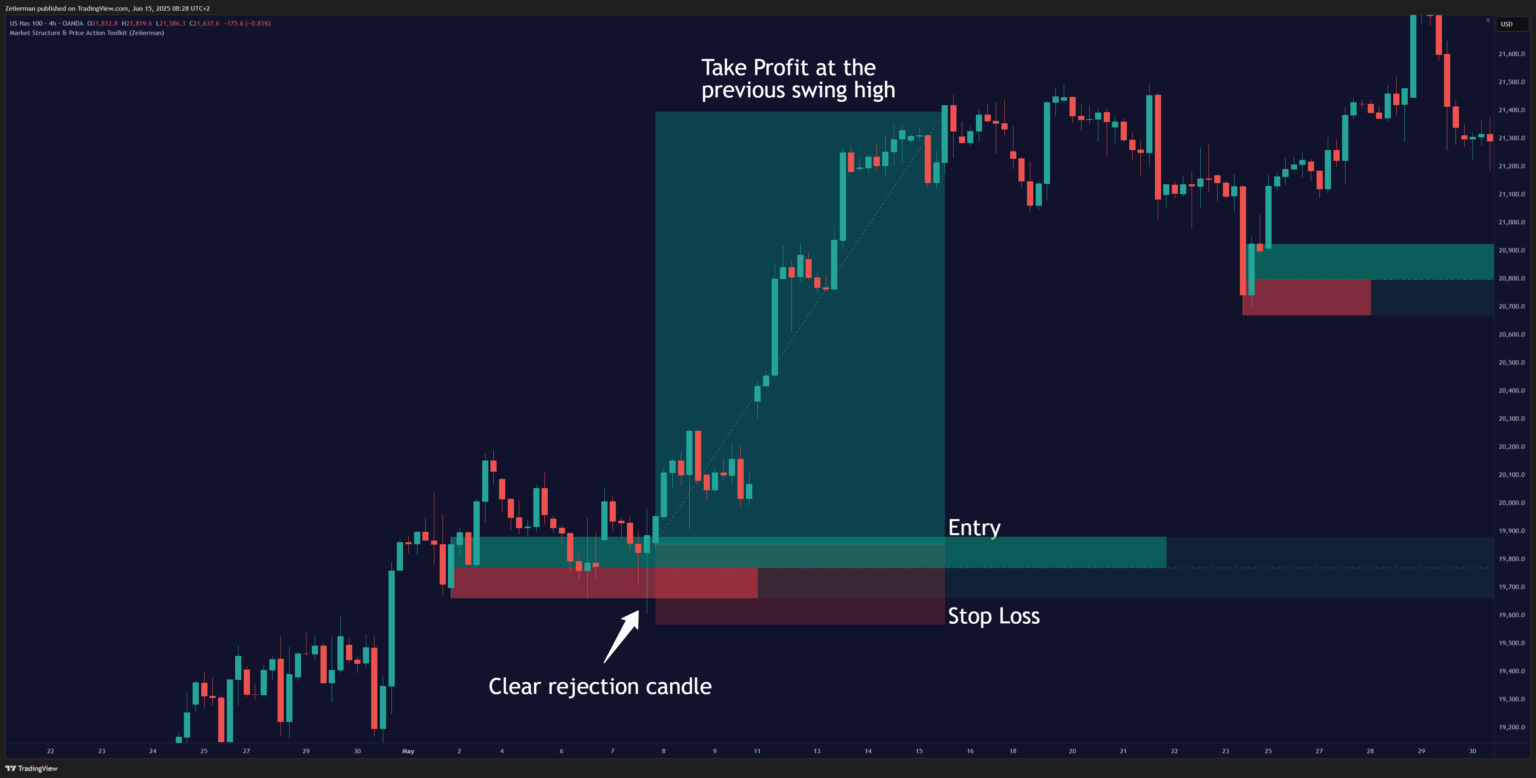

I. Beginner Strategy

This is the most straightforward way to trade OBs — ideal for those new to Smart Money Concepts. Here’s how the set up works:

- Identify a fresh order block using our 3-step identification method given above.

- Confirm market structure alignment. Is this block with or against the trend?

- Wait for the pullback. Patience is everything here.

- Enter on rejection confirmation – never guess, always wait for proof.

Entry Criteria (All Must Be Met):

- Price returns to the order block zone within 5-20 candles of formation

- The sight of a clear rejection candle forms (engulfing pattern, long wick, or doji)

- Volume increase on rejection (where available)

- No major news events within 4 hours of entry

Position Management:

- Stop Loss: 5-10% beyond order block zone (adjust for market volatility)

- Take Profit 1: Previous swing high/low or FVG above/below (1:1.5 minimum risk/reward).

II. The Confluence Strategy

It can be referred to as the OB + Fair Value Gap (FVG) Confluence strategy. This strategy refines your entry using imbalance zones — a concept that institutional desks closely monitor. When an FVG overlaps an OB, it shows the price left behind by unfilled orders during an impulsive move, making prime zones for mitigation. Here’s how the setup works:

- Identify OB on higher time frames (4H/1D) using a 3-step process.

- Look for the Fair Value Gap inside or adjacent to the OB.

- Enter on a touch of the FVG/OB confluence zone, especially after a liquidity sweep.

Advanced Entry Trick: Use a limit order at the 50% mark of the OB-FVG overlap for sniper entries with tight stops.

This is a go-to strategy for swing traders and day traders looking to enter just before the price explodes.

Read: How to use Buy & Sell Indicators7. Frequently Asked Questions (FAQs)

1. What are the best timeframes for identifying order blocks?

Higher timeframes, such as 4H and 1D charts, provide cleaner and more reliable OB zones due to reduced market noise and improved visibility of institutional intention.

2. How do order blocks differ from supply and demand zones?

Supply and demand zones are based on fundamental economic principles. When the price moves rapidly away from a level, it suggests an imbalance between buyers and sellers at that point.

You’re essentially saying, “There wasn’t enough supply here, so the price shot up”, or “There wasn’t enough demand here, so price dropped.” Order blocks go deeper. The zones are based on understanding how institutions actually execute their trades.

3. Can order blocks be used in conjunction with other trading strategies?

OBs pair well with Smart Money Concepts, FVGs, volume profiles, ICT concepts, Fibonacci, and classic technical tools for multi-layered confirmation.