Setting up your take-profit and stop-loss levels for your trade is absolutely a non-negotiable step for any serious trader looking to protect their capital.

Whether you’re a day trader scalping for quick gains or a swing trader playing the longer game, this guide will walk you through various methods to mark your exit points like a pro.

Let’s see each method step by step:

Method 1: Simple On-Chart Method

This is the quickest way to mark your take profit and exits, and it’s perfect if you’re executing a market order or just need a quick setup.

Step 1: Log in to your TradingView account and open the asset chart you will be trading.

Don’t have a TradingView account? Understand how to start trading with TradingView, with extra tips from pros about the settings of tools and layouts that can help you out.

Step 2: To get started with your trade, first connect your broker to TradingView from the “Trading Panel” tab at the bottom menu.

Broker – An online brokerage firm that has integrated with the TradingView platform, allowing users to connect their brokerage account to TradingView and trade directly from the charting interface. To learn how to connect your broker with TradingView, click here.

Step 3: Then get your trade placed directly from the trading panel on the right side of the screen.

- To buy/sell at the current price, go under the “Market” menu and fill in information about the units and margin you want. Then click on the buy/sell option and confirm the market order

- To open an order at a specific price, select the “limit” option and enter the price, units, and margin details. Then, confirm the order.

Once your position is live on the chart, you’ll see a line indicating your entry price.

Read: How to start trading with TradingView? Setting Yourself Up for SuccessStep 4: On the line, you will see symbols of SL (stop loss) and TP (take profit). You can just click and drag those symbols to set the SL and TP at your desired price points.

Step 5: Once you set them on the chart, click on confirm on the right panel, and your orders will be placed.

You can also modify the SL and TP by simply dragging the symbols to another price point and then confirming the order by clicking on the “Modify Order” option on the panel.

Method 2: Using the Trading Panel

If you want to be a little more particular and like to set your levels before you even enter a trade, the trading panel gives you a bit more control and precision on the orders for exits.

Step 1: Log in to your TradingView account and fire up the chart you will be trading.

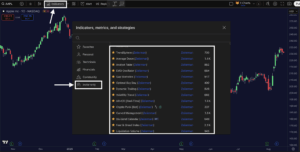

Step 2: Connect your trusted broker with your TradingView account from the trading panel option at the bottom. Once connected, you’ll see a panel for placing orders. It’s usually on the right side of the screen. You’ll see fields for “Limit” and “Market”, choose between the options to proceed

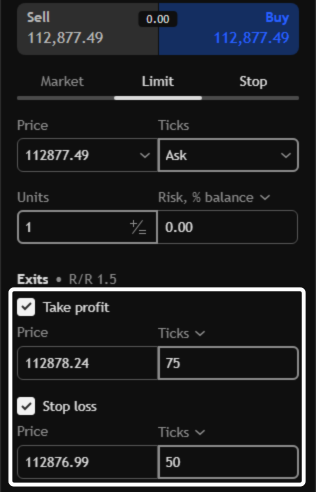

Step 3: Fill your entry price order and enable the “Take profit” and “Stop loss” by ticking the options. Now, a new field will appear where you can enter your desired price for the stop-loss and take-profit directly.

📌 Pro Tip: Instead of just a price, you can also set your TP and SL based on pips or ticks. This is super helpful if you’re using a specific strategy that depends on a fixed number of points from your entry. Just click the drop-down menu next to the price field.

Once you’ve set your levels, you can place your order. TradingView will automatically send the order to your broker with your take-profit and stop-loss levels already attached. This is also known as an OCO (One Cancels the Other) order, which means if one is triggered, the other is automatically cancelled. It’s a slick way to manage your trades from the get-go.

Read: Best Zeiierman Trading Indicators for CryptocurrencyMethod 3: Using the Toolbar

This is a great method for visualising your trade before you pull the trigger on the order.

Step 1: Log in to your TradingView account and open the chart of the asset you want to trade.

Step 2: Connect your broker by clicking on the “Trading Panel” option on the bottom menu of the screen.

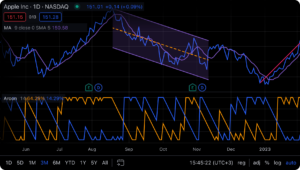

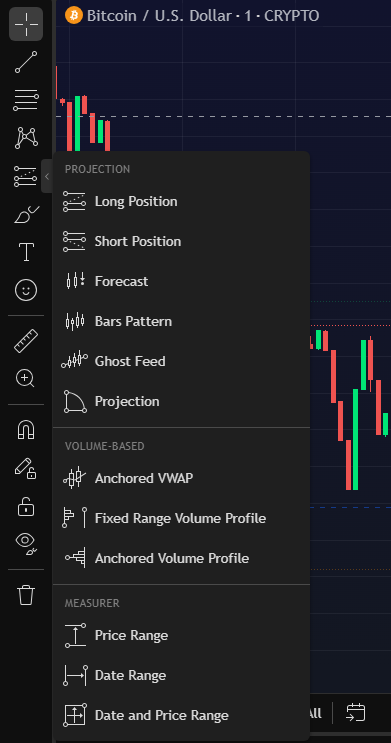

Step 3: On the left-hand toolbar, scroll down until you see the “Forecast and Measurement Tools” category. You’ll find the projection option for Long and Short positions, along with other options. Click on your intended trade option between Long and Short.

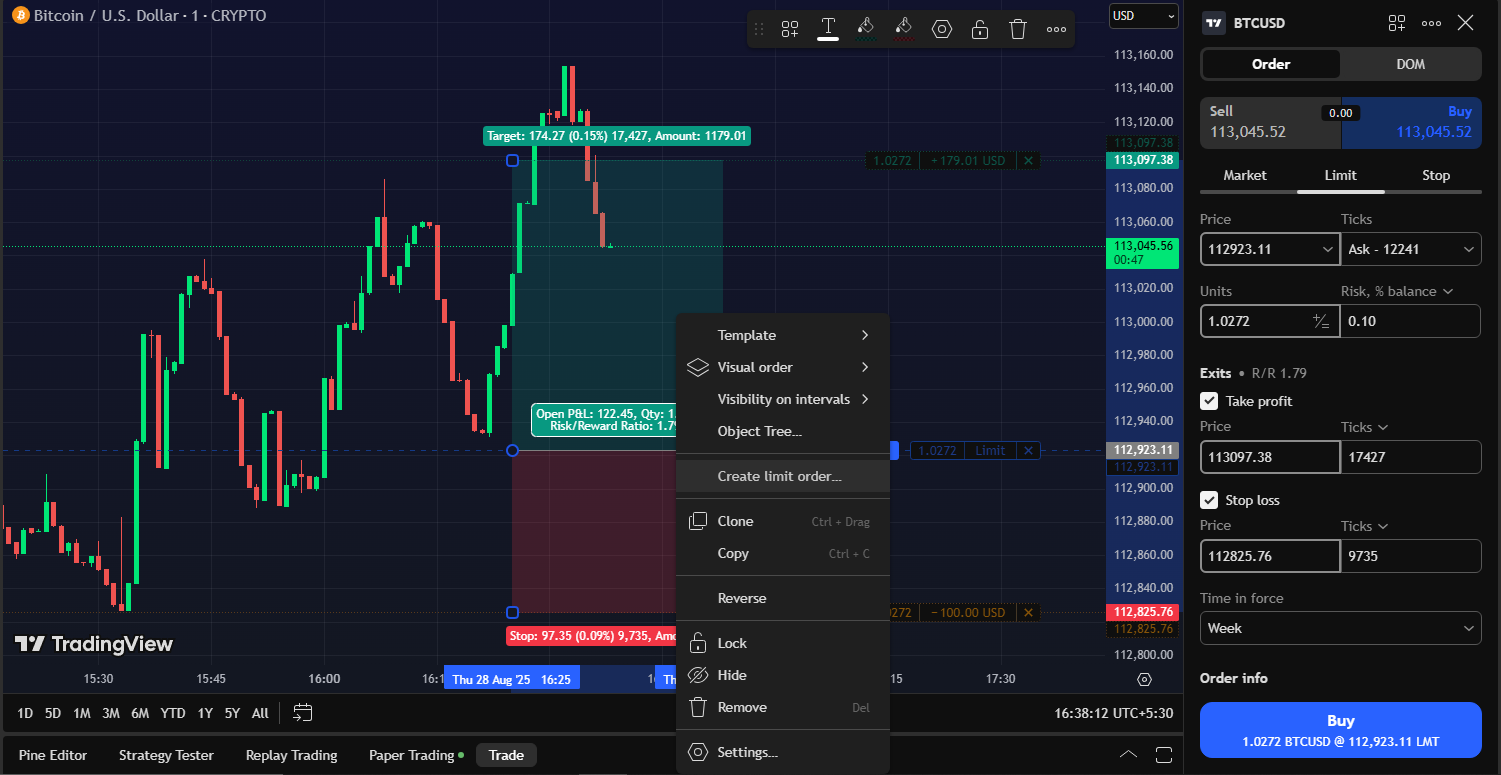

Step 4: Now, click on your chart where you plan to enter the trade. A box will appear, which includes the red part as your stop-loss, and the green part is your take-profit.

You can drag the ends of these boxes up or down to set your levels. As you move them, TradingView shows you all the info like:

- Entry Price: The centre line.

- Target Price: The top of the green box.

- Stop Loss Price: The bottom of the red box.

- Risk/Reward Ratio: It shows you how much you stand to gain versus how much you’re risking.

Step 5: Once you’ve set your levels using this tool, you can simply right-click on the box on your chart and select “Create Limit Order.” This will open the order panel with your take-profit and stop-loss levels already filled in for you. Confirm the order to send it to your broker.

Common Mistakes to Avoid

1. Setting Levels Too Close to the Entry Point

This would lead to trades being prematurely stopped by normal market fluctuations. We use indicators like the Average True Range (ATR) to mitigate this to gauge market volatility and set appropriate levels that accommodate typical price movements.

Pro Tip: Ensure your stop loss level allows some breathing room to avoid being triggered by minor price movements while protecting your capital.

2. Ignoring Market Conditions

Failing to consider current market conditions, such as high volatility or major news events, can lead to inappropriate take-profit and stop-loss levels. Regularly analyze market conditions and adjust your levels accordingly. Stay informed about economic news and events that could impact your trades.

3. Adjusting Levels Based on Emotions

Changing your take profit and stop loss levels based on fear, greed, or other emotions can lead to inconsistent trading results and increased risk. Stick to your predefined trading plan and resist the urge to adjust levels based on emotions. Trust your analysis and strategy.

Can I change take-profit and stop-loss after entering a trade?

Yes, you can change your take profit and stop loss levels after entering a trade, but it’s important to do so thoughtfully and strategically.

Here’s how to manage and adjust these levels effectively:

- If market conditions change significantly after entering a trade, such as increased volatility or new economic data.

- As your trade moves in your favor, you might want to adjust your stop loss to lock in profits and reduce risk. This is known as a trailing stop loss.

- You can adjust your levels to reflect this updated information if new technical analysis provides better insights.