Works on the Following Platforms

TradingView

For use on the TradingView platform

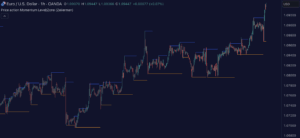

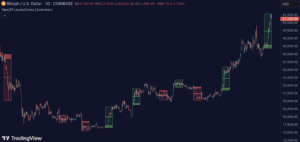

The Trapped Traders – SR Levels/Zones Indicator is an advanced trading tool designed to capture significant market levels where traders are likely to be trapped. This indicator provides a strategic advantage by highlighting potential reversal zones, thereby aiding in decision-making for entries and exits.

Key Features and Functionality

- Trend Sensitivity Adjustment: Configurable settings allow traders to modify how sensitive the indicator is to market trends. This flexibility helps in aligning the indicator with various trading styles, from conservative to aggressive.

- Noise Reduction: The tool includes parameters to smooth out the trend data, which helps in filtering out market noise and focusing on significant movements.

- Depth of Trend Analysis: Traders can set the depth of trend analysis to focus either on long-term movements for broader market insights or on short-term fluctuations for day trading opportunities.

- Momentum Analysis: This feature determines the momentum within the market, identifying potential entry points where traders might be trapped. The momentum analysis can be adjusted to capture more significant shifts or sensitive, quick changes.

- Significance of Momentum: Adjustments can be made to the calculation of momentum’s significance, allowing for a balance between early signal generation and the reliability of these signals.

Visualization and Interaction

- Dynamic Visuals: The indicator employs dynamic visual elements such as lines and zones that respond to real-time market conditions. These visuals help in identifying and distinguishing between zones where buyers or sellers might be trapped.

- Customizable Trend Analysis: Users can choose from several trend analysis methods, each varying in responsiveness and detail, to tailor the indicator to their trading needs.

- Real-Time Updates: The indicator updates in real-time, providing continuous feedback on market conditions and potential trader traps.

Practical Use Cases

- Spotting Reversal Points: By identifying where traders are likely trapped, the indicator provides potential reversal points, useful for setting stop-losses or preparing for entry points.

- Strategy Development: Traders can develop strategies based on the propensity of prices to revert from these trapped zones, employing it in both range-bound and trending markets.

- Risk Management: Enhances risk management by providing clearer zones where the market shows potential overstretched conditions, signaling caution.

Conclusion

The Trapped Traders – SR Levels/Zones Indicator by Zeiierman is an essential tool for traders focusing on volatility and price reversals. Its ability to analyze and present potential trader traps helps in making informed decisions, reducing risk, and potentially increasing profitability by leveraging trapped market sentiment. This tool is especially useful for traders who rely on technical analysis to guide their trading decisions in fast-moving and complex market environments.