Works on the Following Platforms

TradingView

For use on the TradingView platform

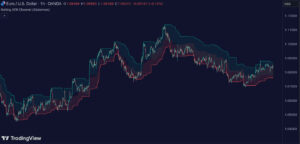

The “ATR + PSAR Trailing Stop (Expo)” indicator is a robust tool designed for traders looking for dynamic stop-loss strategies. This indicator combines the Average 1 Range (ATR) and the Parabolic SAR (PSAR) to set trailing stop levels that adjust to market volatility, making it an essential tool for managing risk in variable market conditions.

How the ATR + PSAR Trailing Stop Works

This indicator utilizes the ATR to gauge market volatility and the PSAR to determine the trend’s direction, helping traders decide on protective stop levels. The trailing stop adjusts as the ATR reflects changes in market volatility and as the PSAR switches its position relative to the price, providing a dynamic method to protect gains or limit losses.

Key Components of the ATR + PSAR Trailing Stop Include:

- ATR Trailing Line: Uses the ATR to set a distance from the price, ensuring that the stop level adjusts in line with recent market volatility.

- Type of ATR Calculation: Traders can select from several ATR types, such as Quick, Adaptive, and Standard, each differing in sensitivity and speed of response to price changes.

- PSAR Trend Determination: The PSAR component helps identify the trend’s direction, offering visual cues and additional confirmation for the trailing stop adjustments.

Usage of the ATR + PSAR Trailing Stop

- Dynamic Stop-Loss Setting: As a primary use, the indicator provides a trailing stop-loss that adapts to both the pace and the direction of the market.

- Trend Confirmation: By integrating the PSAR, traders can use the indicator not just for setting stops but also for confirming the prevailing market trend.

- Risk Management: Adjusting the multiplier and period settings allows traders to manage the risk associated with different trading styles and market conditions.

Features of the ATR + PSAR Trailing Stop

- Customization Options: Offers inputs for ATR period and multiplier adjustments to tailor the sensitivity of the trailing stops.

- Signal Visualization: Includes options to display the ATR trailing line and buy/sell signals directly on the chart, providing straightforward, actionable insights.

- Enhanced Trend Indicators: Additional settings like the ATR ZigZag and Trend ATR enable more nuanced trend analysis and visual cues for easier interpretation.

Conclusion

The “ATR + PSAR Trailing Stop (Expo)” indicator is an innovative tool that enhances traditional trailing stop methodologies by incorporating market volatility and trend direction. Ideal for traders who emphasize risk management in their strategy, this indicator offers a flexible, dynamic approach to protecting capital and locking in profits in varying market environments.